START HERE

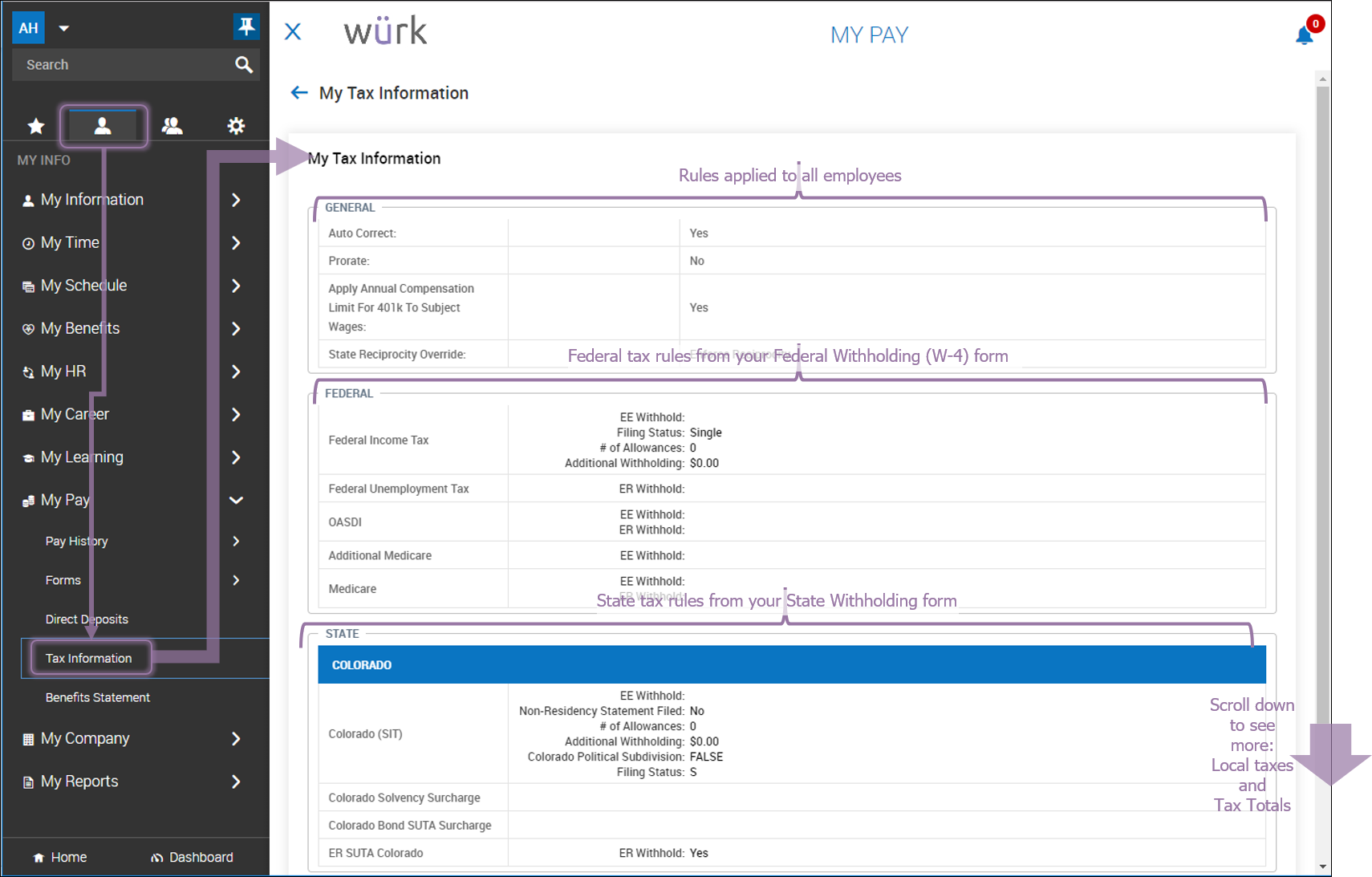

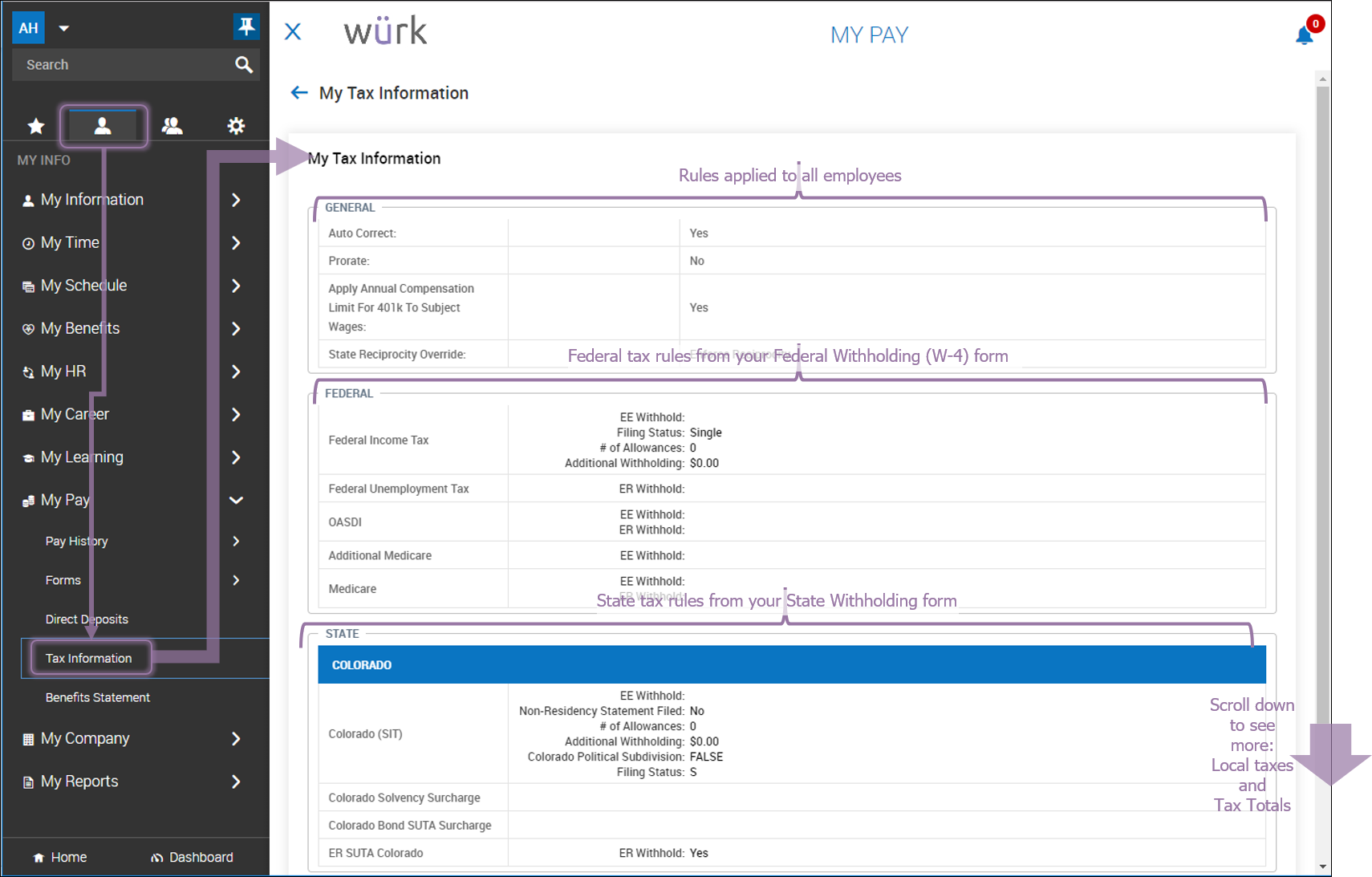

To see your tax deductions, click Tax Information under My Info>My Pay. This shows all tax settings for your paycheck.

Most of the tax deductions shown on this screen come from company-wide settings and your Withholding forms (under My Pay>Forms). To change your tax withholding, you need to update your Withholding forms with HR. You can also simulate withholding variations on your paycheck to see how changes will affect your pay under My Pay>Pay History>My Paycheck Simulator. If you charge your hours to different cost centers, you can see a breakdown of how taxes for each cost center affect your paycheck on your paystub.