START HERE

- Navigate to the Tax Wage Detail Report: Team > Payroll > Reports > Taxes > Tax Wage Details > Tax Wage Details

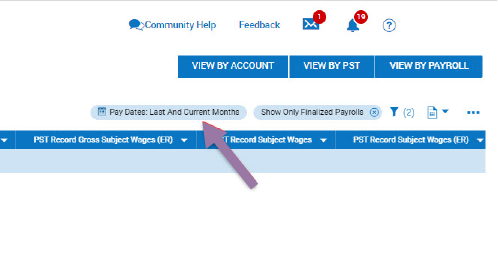

- On the report screen, click on the Pay Dates filter:

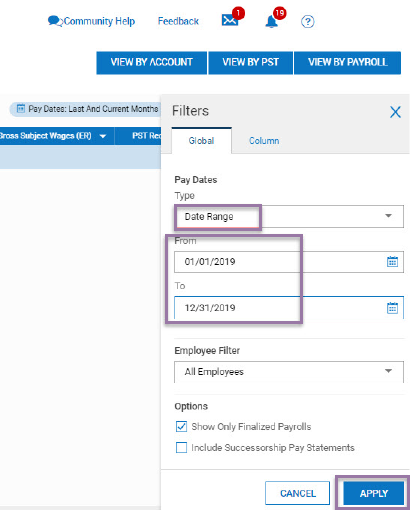

- Change the Pay Date Type to Date Range and enter the proper dates and click Apply:

- For Yearly Balancing use 1/1-12/31;

- For Quarterly balancing use the quarter dates: Q1 1/1-3/31, Q2 4/1-6/30, Q3 7/1-9/30, Q4 10/1-12/31

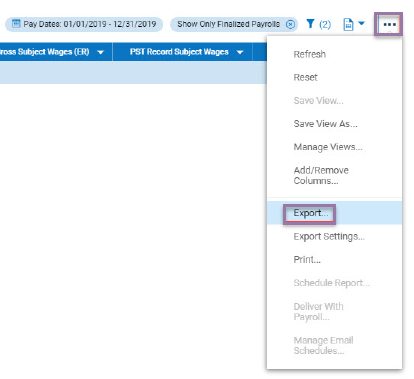

- Export this report by clicking on the ellipses and selecting Export:

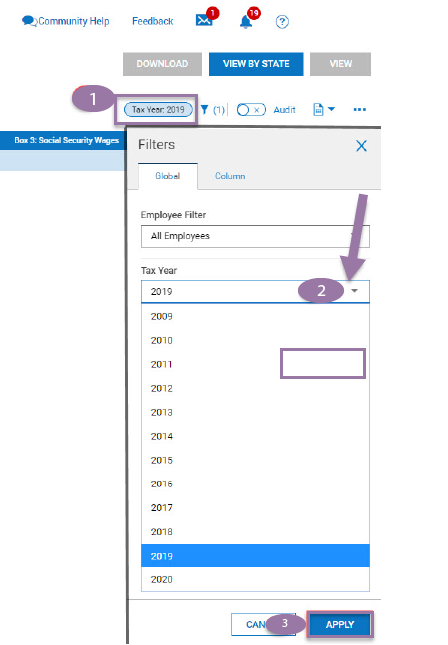

- Navigate to the W2 report screen: Team > Payroll > Forms > W2s

- In the Tax Year drop-down select the proper year.

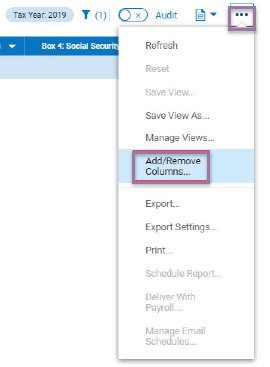

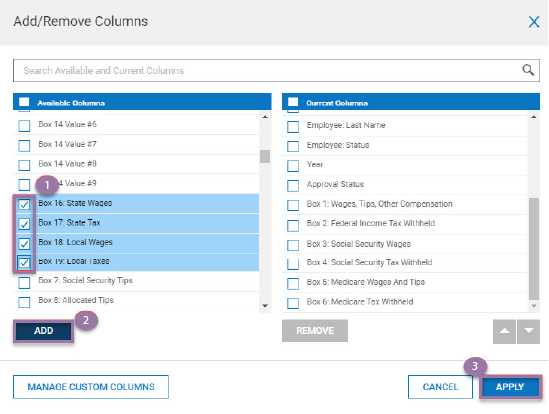

- Once you select the proper year and have clicked apply, navigate to and click on the ellipses menu from the W2 report screen, then select Add/Remove Columns

- Add the following Columns into the report:

- For Withholding Boxes 1, 3, 5, 16, 18

- For Taxable Wages Boxes 2, 4, 6, 17, 19

- In the current report, all the columns showing are on the right of the Add/Remove Column screen. To add columns to this report, locate the columns you want in the left side of the screen and select the checkbox next to each column you want in your report. After you select the columns, click Add to move the columns from the Available Columns (left side) to the Current Columns (right side) of the Add/Remove Columns. Once you have selected all the columns, click Apply.

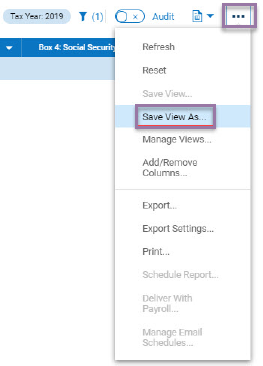

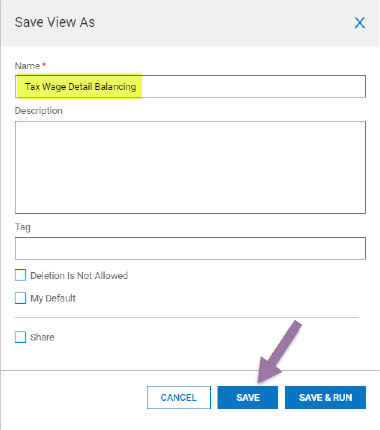

- Once the columns are showing on the screen, we suggest saving this as a report to use for balancing throughout the year.

- To save the report, click on the ellipses and then Save View As:

- On the Save View As screen, name the report but do not set as Default, then click Save.

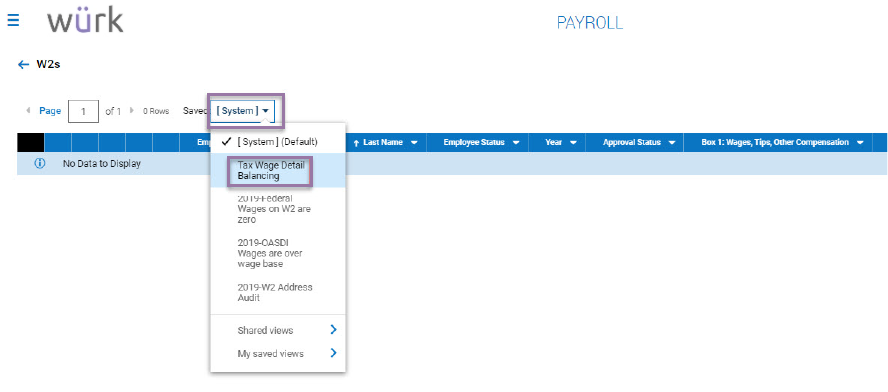

- When you are balancing and need to pull this report, you can find it in 2 places:

- Team > Payroll > Forms > W2's: There is a Saved drop down next to the page & row numbers. Select the drop down and locate your report:

- Under My Saved Reports (My Info > My Reports > My Saved Reports):

- Take the exported Tax Wage Detail Report and match the totals for withholding and taxable wages to the proper boxes on the W2 report.

Balancing Federal, State, Local Withholding

- Tie to W2 Boxes 1, 3, 5, 16, 18 for withholding

- Tie to W2 Boxes 2, 4, 6, 17, 19 for taxable wages

If you are finding differences, first try to recalculate your W2s.

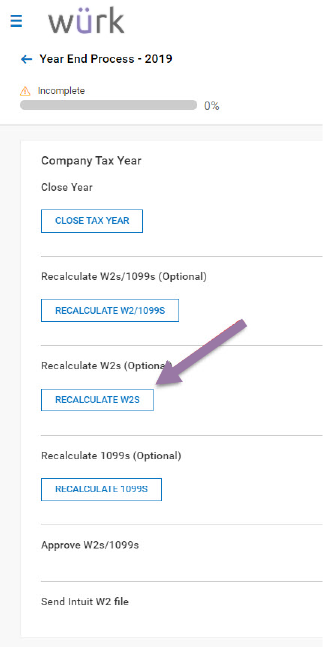

Recalculate W2s:

- Navigate to Team > Payroll > Quarter/Year End Process > Company Tax Years

- From the Company Tax Years screen, click the

icon associated with the proper year.

- Once in the Year-End Processing screen, locate the hyperlink that states 'Recalculate W2s'

- Select this hyperlink to recalculate. Once this is completed, pull a new W2 report from either the My Saved Reports (if you saved your settings) or go back to Team > Payroll > Forms > W2s and pull back in the proper columns.

If you are still seeing differences, you will need to break the Tax Wage Detail Report down by employee and compare each employee to their W2 totals.

- You can get a Tax Wage Detail Report by EE under Team > Payroll > Reports > Taxes > Tax Wage Details > Tax Wage Details (By Account).

- Once you locate an employee that is incorrect, pull the employee's pay statement history. (Team > My Team > Employee Information > locate the EE > click on the

Employee Quick Link icon > select Pay Statement History).

Employee Quick Link icon > select Pay Statement History).

- Review each Pay Statement, starting with the first one of the year, and go check by check to find the difference.

- Once you locate the issue, use a Payroll Adjustment Pay Statement or a reconciliation payroll to correct.

icon associated with the proper year.

icon associated with the proper year. Employee Quick Link icon > select Pay Statement History).

Employee Quick Link icon > select Pay Statement History).